Quickly Link Your NIN to Your Access Bank Account: Step-by-Step

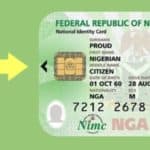

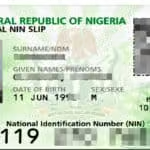

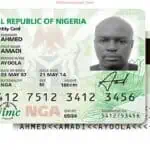

Wondering how to effortlessly link your National Identification Number (NIN) to your Access Bank account, in line with the Central Bank of Nigeria's (CBN) directives? You're not alone! This easy-to-follow guide is designed to simplify the process, ensuring you remain compliant and your banking experience is as smooth as silk. Let's dive into the quick steps to secure your financial dealings and keep your account up-to-date.

Access Bank stands at the forefront of complying with the Central Bank of Nigeria’s (CBN) regulatory directives, taking significant strides to ensure the seamless integration of customers’ National Identification Numbers (NIN) with their bank accounts. This initiative is not merely about adhering to regulations; it’s about enhancing the security and smoothing the banking experience for every customer. If the thought of navigating through the process seems daunting, let this guide put your worries to rest. Designed with simplicity in mind, it will walk you through each step needed to link your NIN to your Access Bank account, ensuring a straightforward and hassle-free experience.

| Bank Name | Access Bank |

| USSD Code | *901*21# |

| Online Linkage | Access Bank NIN Linkage Section |

| Branch Visit | Nearest Access Bank Branch |

| Security | Enhanced |

| Compliance | CBN Directives |

| Process | Simplified |

| Phone Number | Registered Number Required |

The Importance of Linking Your NIN

Linking your NIN to your bank account is a critical step in enhancing the security framework of your banking operations. It’s a measure put in place to protect your account from fraudulent activities and to ensure a transparent financial environment that aligns with the CBN’s directives.

Effortless Ways to Link Your NIN to Access Bank

Access Bank offers multiple avenues for customers to update their account information with their NIN, making the process accessible and convenient for everyone.

Option 1: Via USSD

- Dial *901*21# from Your Registered Phone Number: This is the fastest and most convenient way to link your NIN to your Access Bank account. Simply dial *901*21# from the phone number linked to your bank account, follow the on-screen prompts to enter your NIN, and confirm your details to submit.

Option 2: Using the AccessMore App

- Log In: Open the AccessMore App on your mobile device. Enter your login credentials to access your account.

- Navigate to Menu: Once logged in, look for the menu icon. This is usually represented by three horizontal lines or a grid icon, typically located at the top or bottom of the screen. Tap on this icon to open the menu.

- Select Accounts: In the menu options, find and select “Accounts”. This will take you to a screen where you can manage your account settings.

- Link NIN: Within the Accounts section, you should see an option to link your National Identification Number (NIN). Select this option and follow the on-screen instructions to complete the linking process.

Option 3: Through Access Bank’s Website

- Log In: Open your web browser and go to your bank’s Internet Banking login page. Enter your login details to access your account.

- Locate the Link NIN and BVN Bar: Once you are logged in, look at the top of the screen for a bar or a notification that says “Link your NIN”. This is usually prominently displayed to help users easily find it.

- Follow the Instructions: Click on the “Link your NIN” bar. You will be redirected to a page where you can enter your NIN and BVN details. Follow the on-screen instructions to complete the linking process.

Option 4: In-Person at a Branch

- Visit Your Nearest Access Bank Branch: If you need assistance or prefer handling your banking needs in person, visiting an Access Bank branch is a reliable option. The staff can guide you through the NIN linking process, ensuring that your account is updated securely.

Why This Matters

The process of linking your NIN to your bank account is more than a regulatory requirement; it’s a step towards safeguarding your financial identity and ensuring the security of your banking transactions. Access Bank is dedicated to providing a secure and efficient banking experience, and by following these simple steps to link your NIN, you’re contributing to a safer banking environment.

In Conclusion

Access Bank’s commitment to compliance and customer security is evident in the streamlined process for linking your National Identification Number to your bank account. Whether you choose to use the USSD service, the online portal, or visit a branch in person, Access Bank has ensured that each method is designed with your convenience and security in mind. By taking this essential step, you’re not just complying with a regulatory directive; you’re enhancing the security and efficiency of your banking experience. Remember, Access Bank is here to assist you every step of the way, ensuring that your banking needs are met with professionalism and ease.

Share This Post: If this post helped you, share it with others! Use the buttons below to spread the word!